National Beef Checkoff Resources

Beef Checkoff Compliance

Paying Your Checkoff

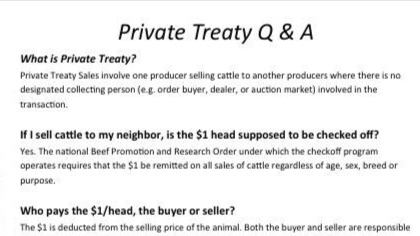

By law, all producers selling cattle or calves, for any reason and regardless of age or sex, must pay $1-per-head to support beef/veal promotion, research and information through the Beef Promotion and Research Act. Here are some specifics:

- Whoever makes payment to the seller is considered a "Collection Point" or person and must withhold $1-per-head, remitting those funds to the Qualified State Beef Council (QSBC) where they live. Collection points could include auction markets, feedyards, dealers/order buyers, other producers, auctioneers, clerking services, banks, packers and other entities.

- The buyer is generally responsible for collecting $1 per head from the seller. By law, both buyer and seller are equally liable to see that $1-per-head has been collected and paid.

- Also under the Act and the Order, the State Beef Council is legally responsible for collecting monthly assessments as well as a two percent late charge on checkoff remittances if they are not received in our office postmarked by the 15th of the month following the month of sale.

- No producer is exempt from the checkoff. Buyers who resell cattle no more than 10 days from the date of purchase may file a non-producer status form and avoid paying an additional dollar. They are, however, responsible for remitting collected funds and reporting any transaction to the QSBC.

- Remember: A dollar or a document! All selling/purchase transactions must be reported. In each case, either $1-per-head or non-producer status form document must be collected by the buyer from the seller to show the dollar has been collected and paid within the past 10 days.

- If it's more convenient, the seller of cattle may collect and remit funds collected. For instance, purebred breeders selling to many different buyers may wish to remit the checkoff themselves; persons exporting cattle should also pay when the cattle change hands. Buyers should keep receipts showing the checkoff has been paid.

- Persons in non-compliance with the Act and Order are subject to a civil penalty of up to $7,500 per transaction, plus unremitted checkoff dollars and interest.

Research shows the checkoff returns more than $11 to the industry for every dollar invested.

Instructions for Completing the Monthly Checkoff Remittance Form

The completed form should be sent along with payment to:

INDIANA BEEF COUNCIL

PO BOX 3316

INDIANAPOLIS, IN 46206-3316

Learn more about the Beef Checkoff Program

Private Treaty Checkoff Remittance Form

Examples: Freezer beef, show calves, seedstock sales.

Monthly Checkoff Remittance Form

Used by monthly remitters such as sale barns and processors.

Producer Redirection of Assessments Form

Use only if you want to send your entire $1 per head to national CBB